Understanding Section 179 can help many business owners make smart end-of-year decisions, especially if they are considering upgrading their work vehicle. At Hondru Chevrolet of E-Town, located at 2005 S Market St in Elizabethtown, PA, we enjoy helping local businesses explore their options. If you are near Lancaster, Harrisburg, Marietta, or Middletown, this overview will give you a simple look at how Section 179 may support your business goals.

Section 179 Tax Benefits

Section 179 Tax Deduction for 2025

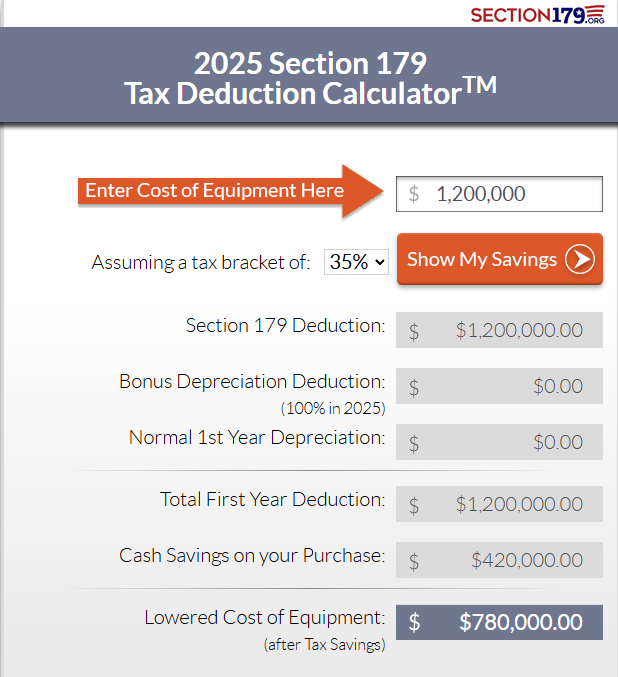

The above is an overall "birds-eye" view of the Section 179 Deduction for 2025. Contact us for more details on limits and qualifying equipment.

Here is an updated example of Section 179 at work during the 2025 tax year.

Take Advantage of the 179 Tax Deduction

If you're the owner or manager of a business and are purchasing vehicles for a fleet or business use, you can take advantage of the Section 179 tax deduction. As you plan for a new Chevrolet business vehicle, you'll want to learn more about this deduction to help you save money for your company.

How the Section 179 Deduction Works

This part of the tax code allows a business to deduct the purchase price of a vehicle during that year instead spreading it as depreciation. If you buy a vehicle and use this deduction, you get to claim the full price the same year you made the purchase. Because some businesses have used the deduction to write off expensive vehicles that may not meet the criteria, the code has been changed to reduce the advantages. However, many organizations can still benefit from the savings with vehicles they purchase for business use.

Using this deduction is helpful for small businesses that are trying to expand their business or just supply the company with the necessary equipment. They can deduct the total price to reduce the amount of profit shown, which reduces the amount of taxes they must pay. While large companies can also use the deduction, it was created to help small organizations.

Limits for the Deduction

Most businesses will qualify to use the Section 179 deduction, However, there are limits to its usage. The cap for the year is $1,160,000 and is reduced after $2,890,000. The deduction is no longer appliable after $4.050,000 worth of equipment is purchased, making it more beneficial for smaller businesses.

The section requires businesses to limit deductions to equipment that is used more than 50 percent of the time for the company. In other words, you couldn't claim a truck that you bought for personal use and occasional use for your company. A truck that is used every day for the business and driven home by the owner or employee would likely qualify for the deduction.

What This Means for You

If you're considering buying a new vehicle or adding multiple vehicles to your fleet, now may be the time to make the purchase. You can deduct the total price on this year's taxes, reducing your bottom line for tax purposes. If you have questions about this deduction or about purchasing a new vehicle, you can talk to the finance team at Hondru Chevrolet of E-Town.

While any vehicle can qualify for the deduction, you will find specific vehicles at our dealership that may be ideal for your business needs. You can check out the Chevrolet Silverado 1500, 2500, or 3500. Now might be the time to consider going electric with the Silverado EV. No matter which model you select, you'll find the best incentives right here.

Why Local Business Owners Choose Hondru Chevrolet of E-Town

Our dealership makes it easy for business owners across Elizabethtown, Lancaster, and Harrisburg to find a truck or SUV that fits their day-to-day needs. You can shop our new specials to see current offers, view our certified pre owned inventory for like-new Chevy models, or check our service center for routine maintenance support. We also provide simple online tools that help you value your trade or schedule service.

Financing and Tools for Your Purchase

If you plan to buy a qualifying vehicle for your business, our team is here to help. We offer financing for all customers and can walk you through your options in a simple and clear way. You can also use our online finance application whenever you are ready to begin.

Many local business owners appreciate how straightforward the process is, from choosing the model to arranging service after purchase. Whether you drive in from Lancaster or commute from Harrisburg, our team is here to support every step.

Learn More or Get Started Today

If Section 179 seems like it may benefit your business, our team at Hondru Chevrolet of E-Town is ready to help you explore vehicles and answer questions about model features. We encourage you to speak directly with your tax advisor to understand what qualifies for your situation. To explore available Chevy trucks and SUVs, feel free to visit our homepage or contact our staff anytime.

Please visit www.Section179.Org for more information.

Let Hondru Chevrolet of E=Town help you build your business with a new vehicle. Stop by the dealership if you live in Lancaster, Harrisburg, or elsewhere in central Pennsylvania and see our new inventory.

How Can We Help?

* Indicates a required field